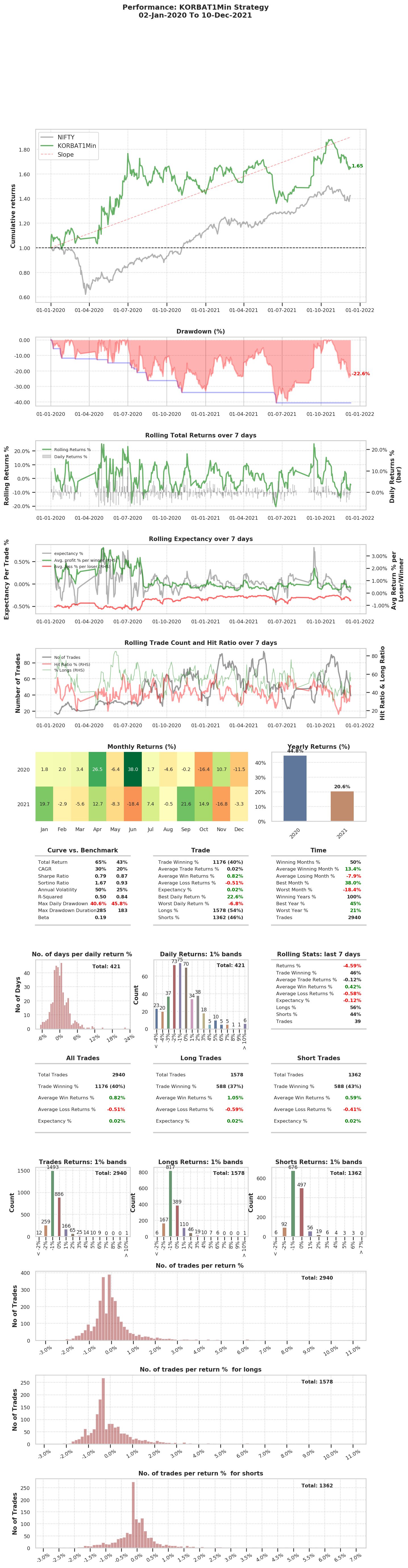

KORBAT Strategy

KORBAT is an intraday momentum chasing strategy. With a very weak conviction, it seeks to identify up to five stocks on a daily basis along with expected direction of movement using mathematical algorithms and hopes that the selected stocks hit jackpot. Once an entry has been made in a ticker, it waits till a large gain has been captured, while it exits quickly on losses. The strategy also takes significant amount of leverage. In live markets, up to five times the capital is normal, while it has taken up to eight times leverage as well. Our stock universe for this model is made up of hundred most liquid stocks and hence we are largely confident that our selected tickers will have continuous market during trading hours and we would be able to exit at desired levels without incurring too much slippage cost.In this strategy, there is extreme emphasis on risk management on things like how much leverage to put on, the position size of each trade, the risk inherent in each trade as well as well as overall risk in portfolio. It makes more than adequate provisions for costs like slippages etc while simultaneously adjusts for market peculiarities like changing volatility as well intermittent momentum exhibited by stocks. Risk on a daily basis is predefined and the key performance ratio is hit ratio (no of winners/ total number of trades).

So, on our portfolio, the downside risk is predefined, and we seek to achieve a targeted hit ratio. If we are able to achieve the targeted hit ratio, we get confirmation that our model is working as expected, irrespective whether returns have been achieved or not. We hope that once desired hit ratio is maintained, the portfolio will generate returns over long run. This easily and clearly verifiable test gives us great confidence in running the model in live market.